Basic Stance

The Group formulated a long-term management vision for 2030, VIORB 2030, to help realize a fulfilling society by putting into practice our purpose of “supporting the sustainable generation of energy and industrial activities in harmony with the global environment.”

While working to realize a sustainable society from the standpoints of environment, society and economy and enable Seika to contribute to the global environment through initiatives to address climate change, we aim to balance these efforts with activities to achieve corporate growth.

Information Disclosure Based on TCFD Recommendations

Governance and risk management

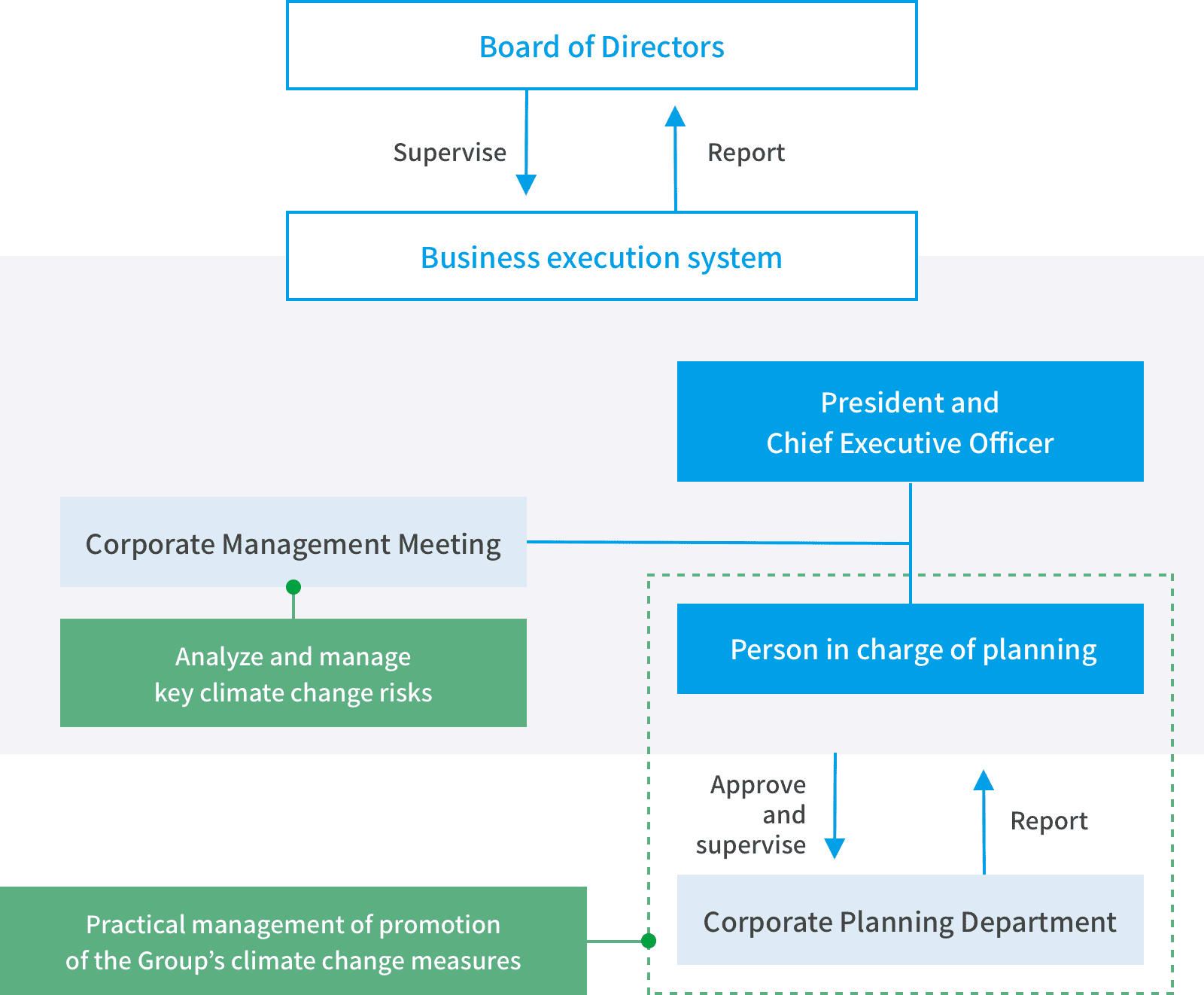

The managerial control of the Group’s practical business of promoting measures to address climate change is performed by the Corporate Planning Department under the supervision of the Board of Directors. The Corporate Planning Department collaborates with business units, headquarters, and subsidiaries within the Group to incorporate climate change risks and opportunities into business strategies and study measures for issues related to climate change as well as management indicators and targets, and the Department reports to the Corporate Management Meeting and other meetings through the Executive Officer in charge and the Board of Directors.

Key risks, etc. related to climate change are analyzed by the Corporate Management Meeting in the same way as the process for company-wide risk management, and the impact and management status are reported to the Board of Directors as appropriate.

Strategy: climate change risks and opportunities

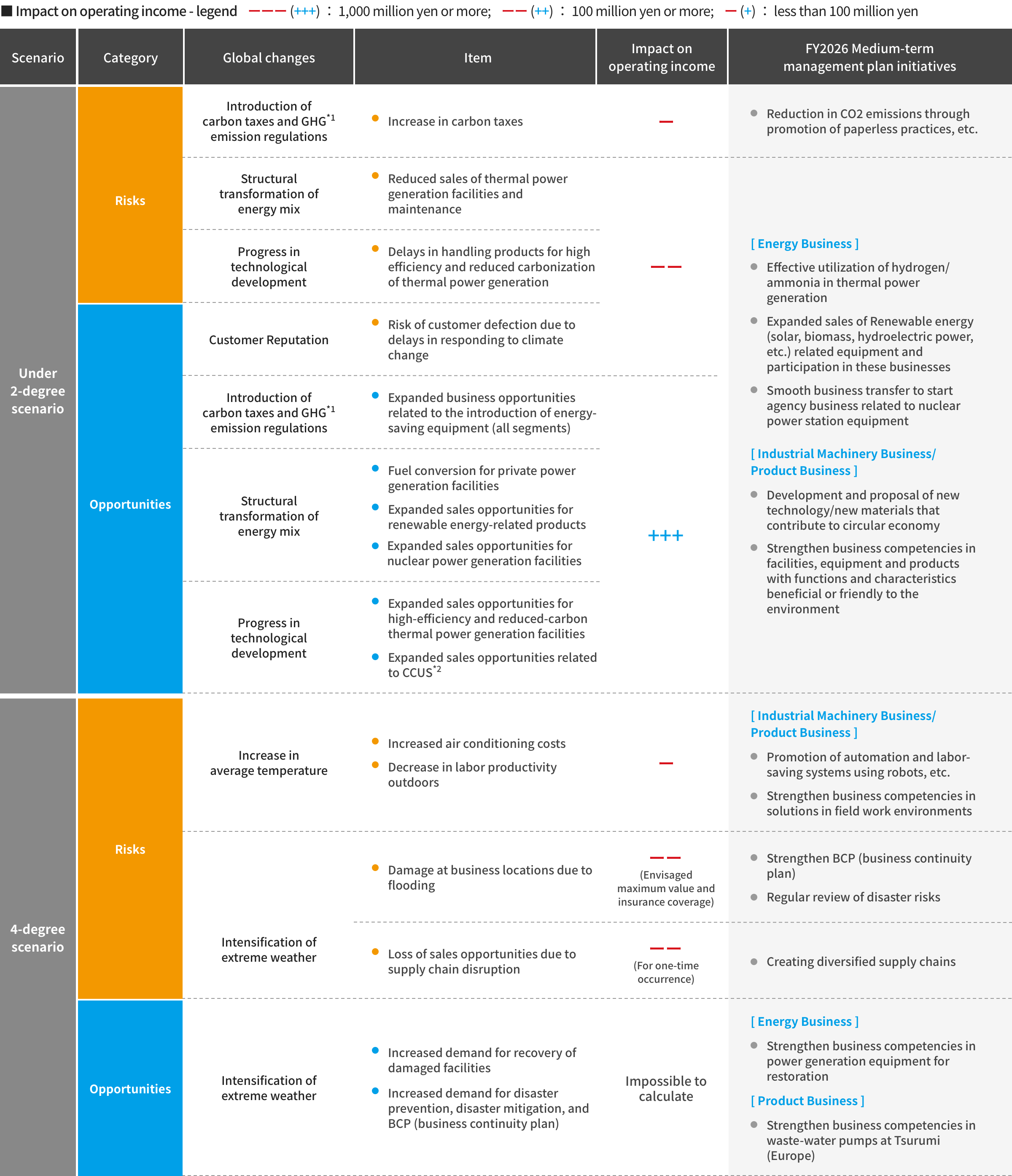

Based on the TCFD framework, we conducted a qualitative analysis of the impact of climate change on our business and performance.

| Scenarios |

Scenario analysis was performed based on the following two scenarios. Under 2-degree scenario: Scenario in which there is a transition to a low-carbon economy 4-degree scenario: Scenario in which the physical climate change risk increases For climate change scenarios, we used IPCC SSP1-2.6, and IPCC SSP5-8.5. The time frame of the analysis is basically based on 2030 for a transition risk and 2050 for a physical risk. |

|---|---|

| Target scope | Seika Corporation and the four subsidiaries, Nippon Daiya Valve Co., Ltd., Shikishimakiki Corporation, Seika Daiya Engine Co., Ltd., and Tsurumi (Europe) GmbH, were selected for analysis. The above analyzed companies account for more than 90% of the Company’s consolidated net sales and operating income. |

The identified climate change risks and opportunities are indicated below. We are promoting initiatives set forth in the medium-term management plan aimed at addressing identified risks and maximizing opportunities.

※2:Carbon Capture, Usage, and Storage

Indicators and targets

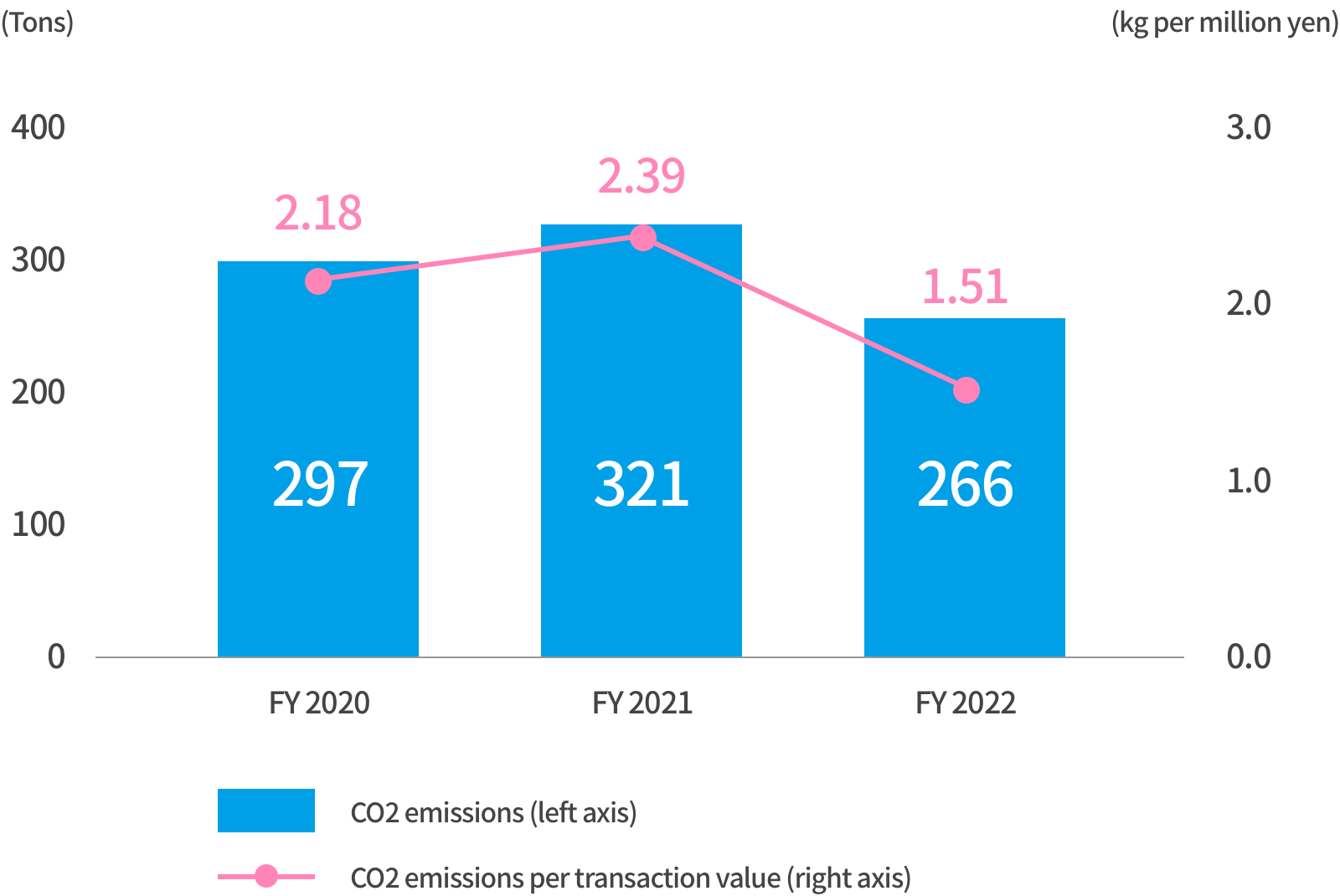

The CO2 emissions of Seika Corporation (alone) are shown below. In the future, we will promote the acquisition of Scope 1 and 2*3 greenhouse gas (GHG) emissions of Group companies, and quickly disclose the GHG emissions and reduction targets for the Group as a whole. In addition, we will promote information sharing with suppliers in the supply chain and make efforts to acquire Scope 3 GHG emissions for the Group.

*3

Scope 1:Direct GHG emissions produced by our own business (fuel combustion, industrial process)

Scope 2:Indirect emissions related to the use of electricity, heat, and steam provided by other companies

Scope 3:Indirect emissions beyond Scopes 1 and 2 (emissions by other companies related to business activities)

CO2 emissions of Seika Corporation (alone)

Promotion of green innovation-related products

In addition, the Company is making proactive efforts to achieve carbon neutrality as a general machinery trading company by utilizing its experience and business infrastructure cultivated in the electric power business and chemical and energy business.

As specific efforts, the Company is promoting the deployment and expansion of “green innovation-related products” to help customers reduce GHG emissions, and our transaction results for FY ended March 31, 2022 are shown below.

| Transactions handled for green innovation-related products in FY ended March 31, 2022 | Results The figures in ( ) show the percentage year-on-year changes. |

Target | |

|---|---|---|---|

| FY2022 | FY2026 | FY2030 | |

| Products for energy and resources conservation and increased efficiency | 85,800 million yen (+10%) | 180,000 million yen | 200,000 million yen |

| Products to prevent pollution | 9,700 million yen (+61%) | ||

| Products for recycling and reuse | 1,000 million yen (+11%) | ||

| Total | 96,500 million yen (+14%) | ||

Based on the above efforts, we will also examine long-term targets for achieving carbon neutrality.

Initiatives Related to Capturing GHG Emissions

The initiative to realize a decarbonized society is one of the basic policies of “VIORB 2030,” our long-term management vision.

In addition, we are continuing to perform scenario analysis to identify the GHG emissions of the Group, and we are making efforts to reduce these emissions.

| Target scope | Seika Corporation and the four subsidiaries, Nippon Daiya Valve Co., Ltd., Shikishimakiki Corporation, Seika Daiya Engine Co., Ltd., and Tsurumi (Europe) GmbH, were selected for analysis. The above analyzed companies account for more than 90% of the Company’s consolidated net sales and operating income. |

|---|---|

| Aggregation target | CO2 emissions (Scopes 1 and 2 and part of Scope 3) |

| Emission factors |

1. Electric Power ・Japan: Use emission factors by electric utility (adjusted emission factors) ・ Overseas: Use CO2 emission factors by country according to the International Energy Agency (IEA) 2. Other Use the “List of Calculation Methods and Emission Factors” for GHG emissions published by the Ministry of the Environment |

Measures to reduce CO2 emissions